san antonio local sales tax rate 2019

This is the total of state county and city sales tax rates. San Antonio TX 78283-3966.

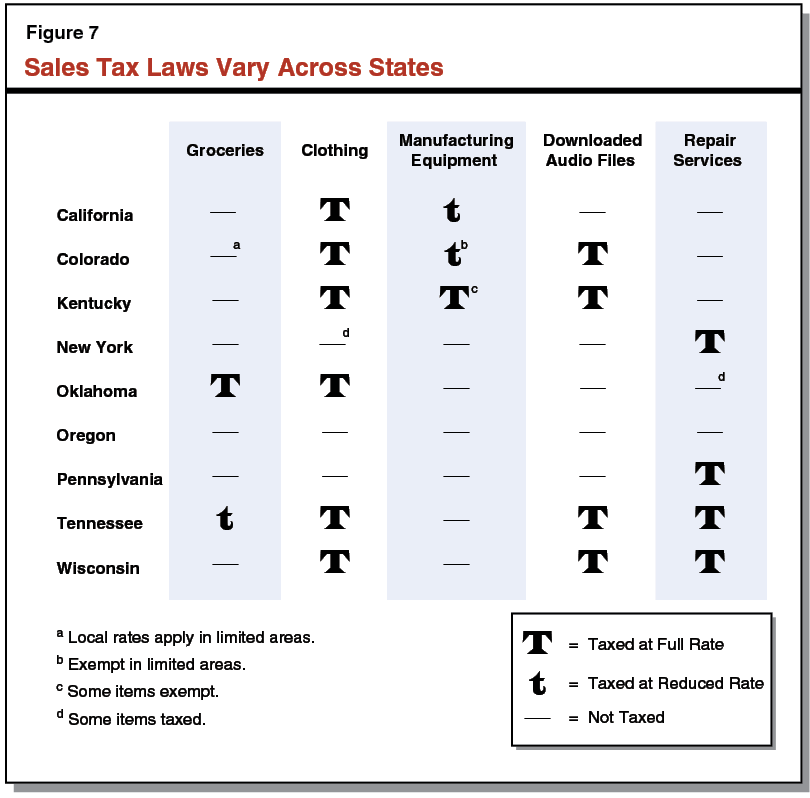

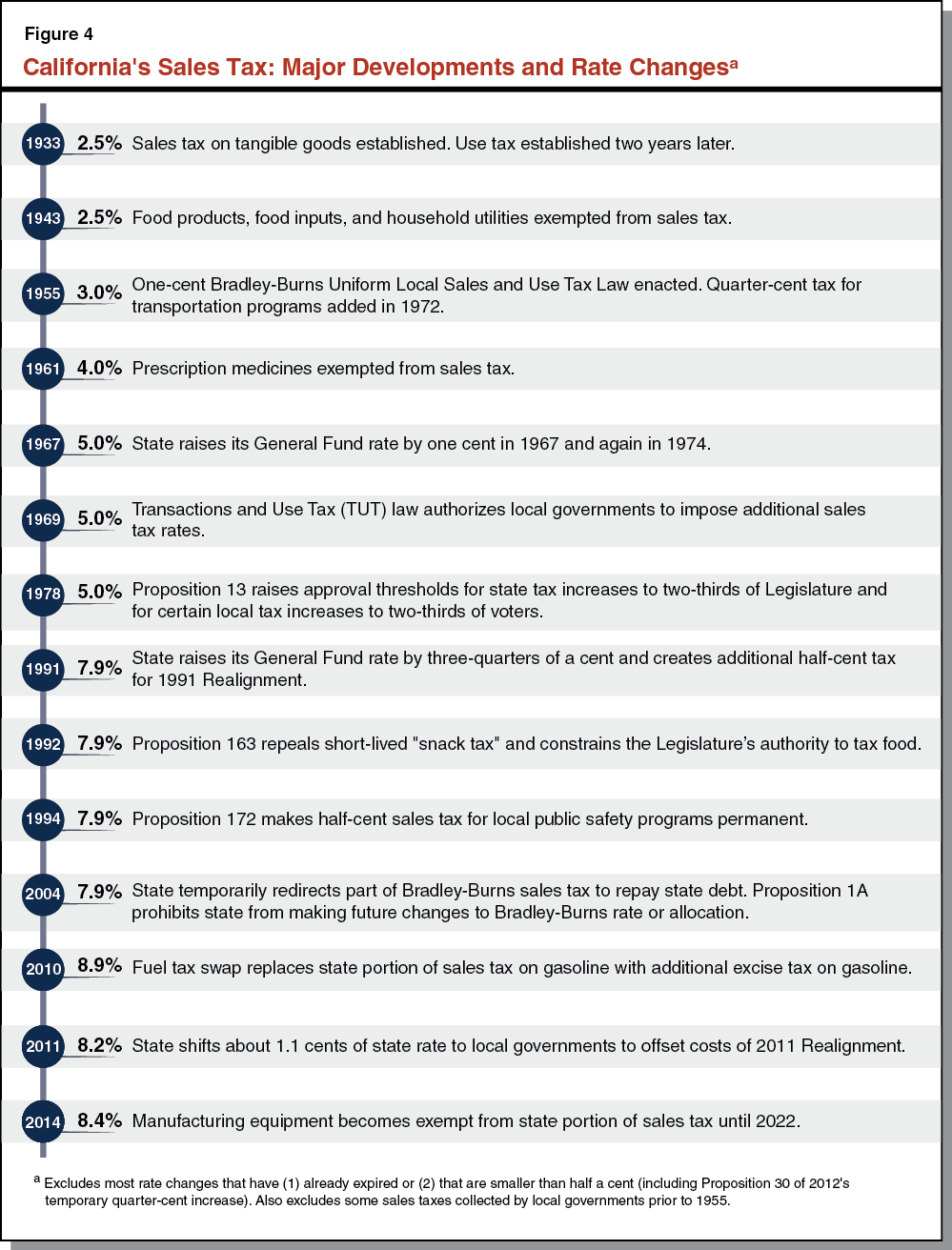

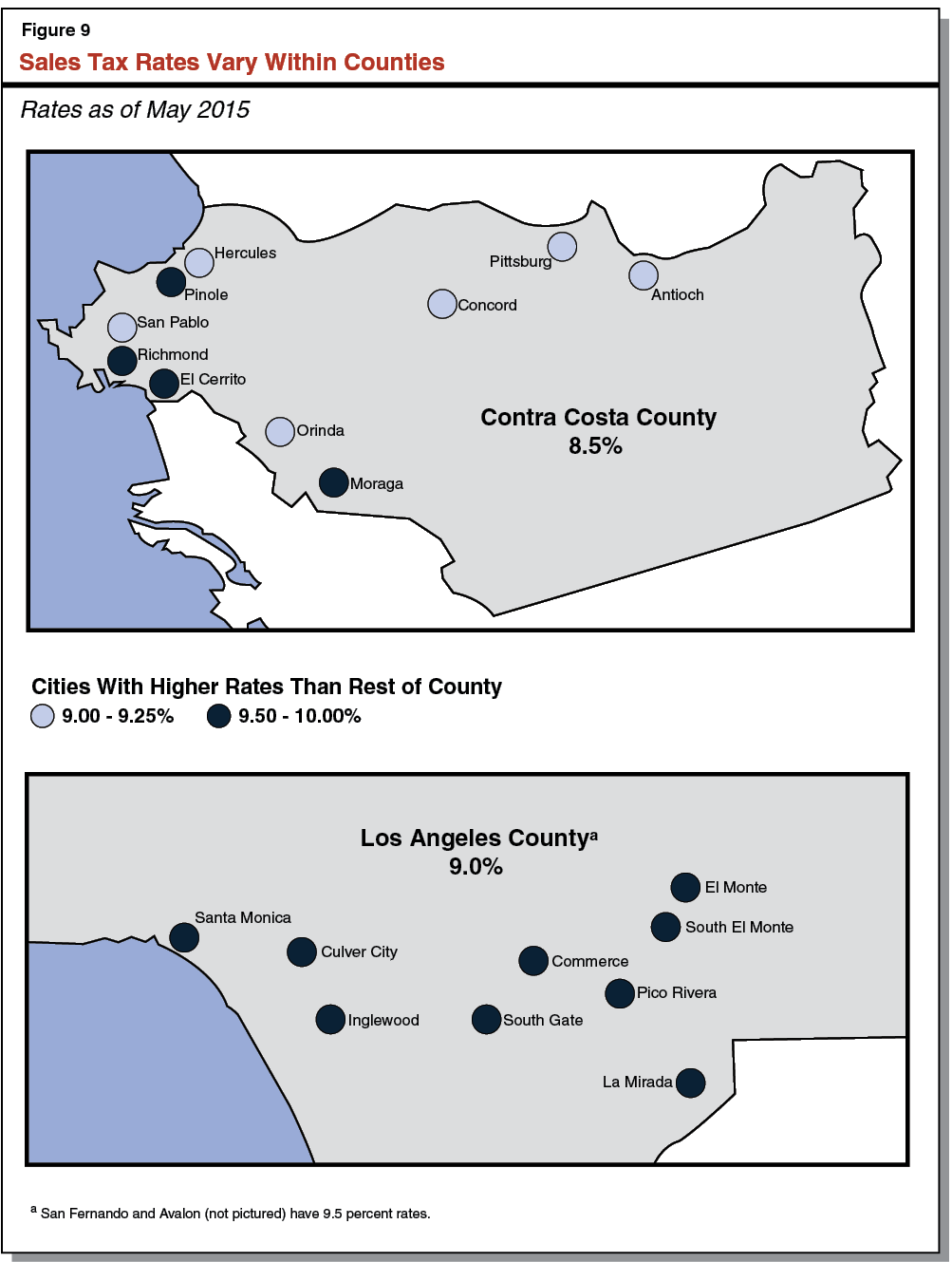

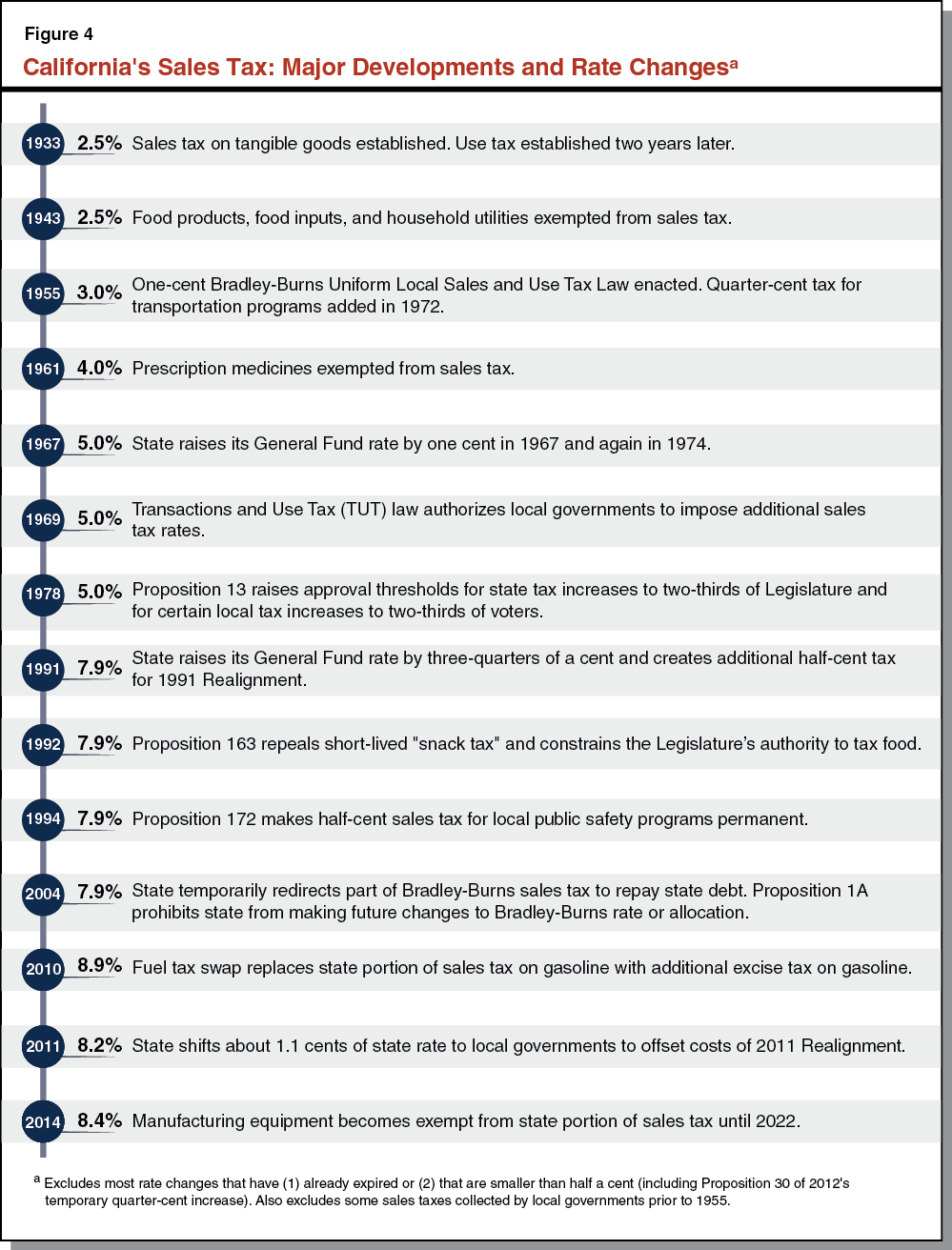

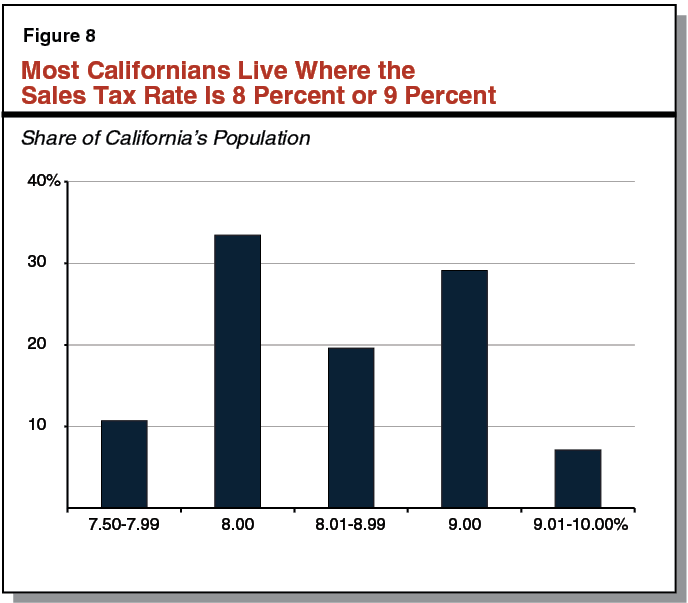

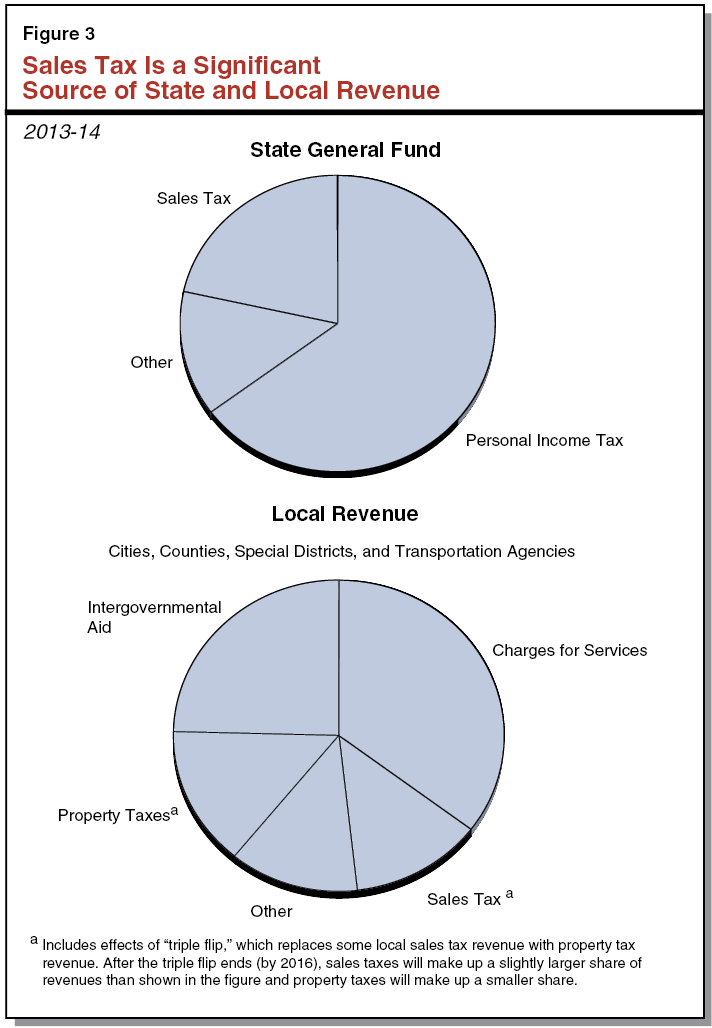

Understanding California S Sales Tax

There are approximately 3897 people living in the San Antonio area.

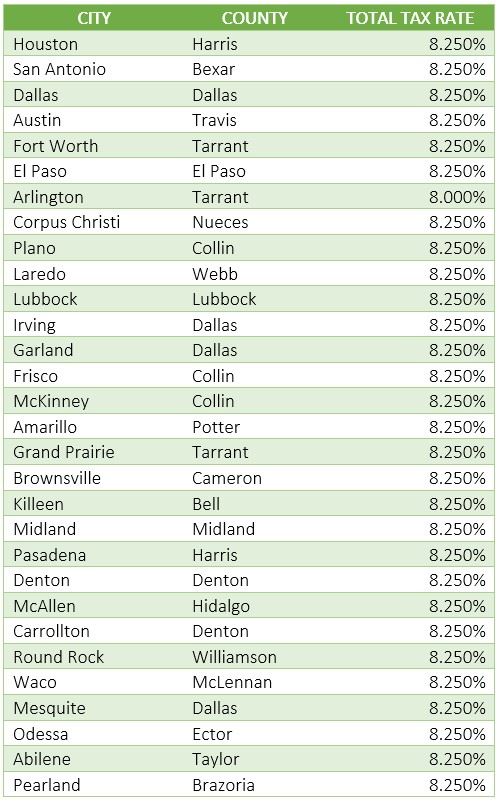

. Texas Comptroller of Public Accounts. Every 2019 combined rates mentioned. The san antonio texas general sales tax rate is 625.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The san antonio texas sales tax is 825 consisting of 625 texas state sales tax and 200 san antonio local sales taxesthe local. City sales and use tax codes and rates.

The San Antonio Florida sales tax rate of 7 applies in the zip code 33576. The san antonio sales tax rate is. The portion of the sales tax rate collected by San Antonio is 125 percent.

2020 rates included for use while preparing your income tax. 1000 City of San Antonio. The minimum combined 2022 sales tax rate for San Antonio Texas is.

Some cities and local governments in Bexar County collect additional local sales taxes which can be as high as. The San Antonio Texas general sales tax rate is 625. This rate includes any state county city and local sales taxes.

The December 2020 total local. The Fiscal Year FY 2022 MO tax rate is 34677 cents. The Texas sales tax rate is currently.

Rates will vary and will be posted upon arrival. Published on June 25 2019 by. Monday - Friday 745 am - 430 pm Central Time.

Maintenance Operations MO and Debt Service. This rate includes any state county city and local sales taxes. San Antonio Local Sales Tax Rate.

San antonio fl sales tax rate. The portion of the sales tax rate collected by San Antonio is 125 percent. 127 rows Birmingham has the highest local option sales tax rate among major cities at 6 percent with Aurora Colorado 56 percent St.

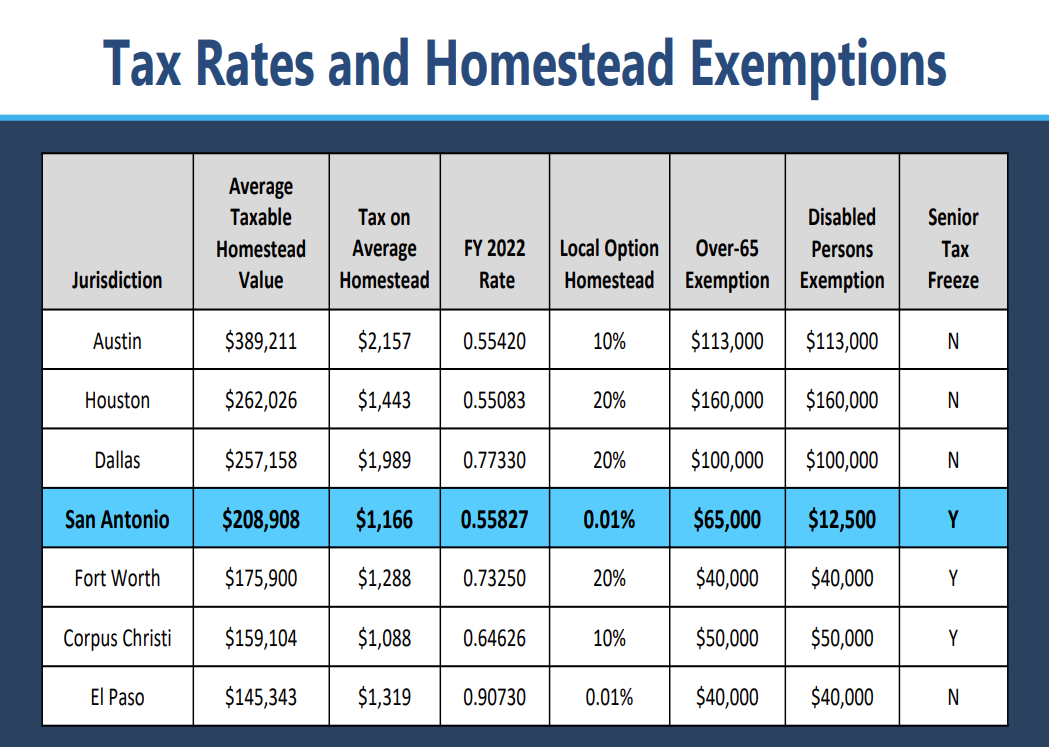

The County sales tax. Is a veteran staff writer. City of San Antonio Property Taxes are billed and collected by the Bexar County.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. 0495 as of 2019 tax year. The current total local sales tax rate in San Antonio TX is 8250.

Jurors parking at the garage. Louis Missouri 5454 percent and. Published on September 20 2019 by Youngers Creek.

The property tax rate for the City of San Antonio consists of two components. Local Code Local Rate Total Rate. Remember that zip code boundaries.

The latest sales tax rate for San Antonio TX.

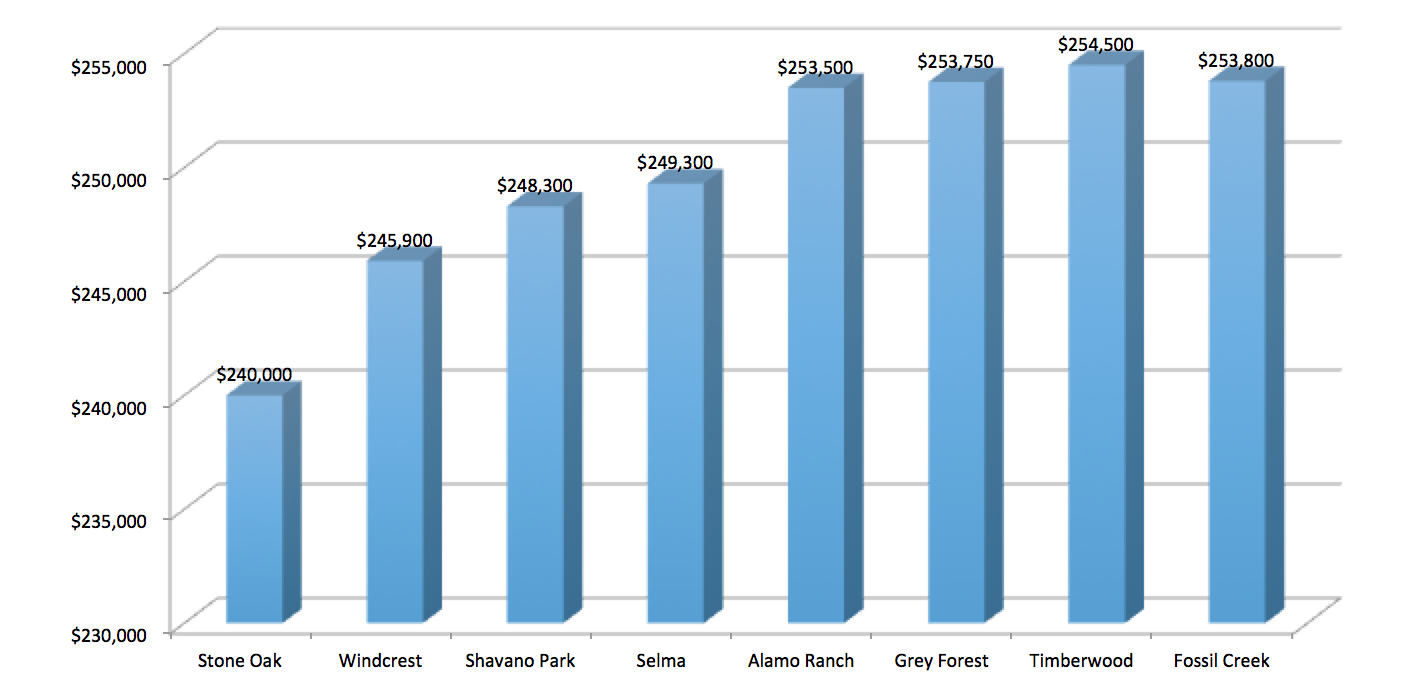

Financial Transparency Selma Tx Official Website

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

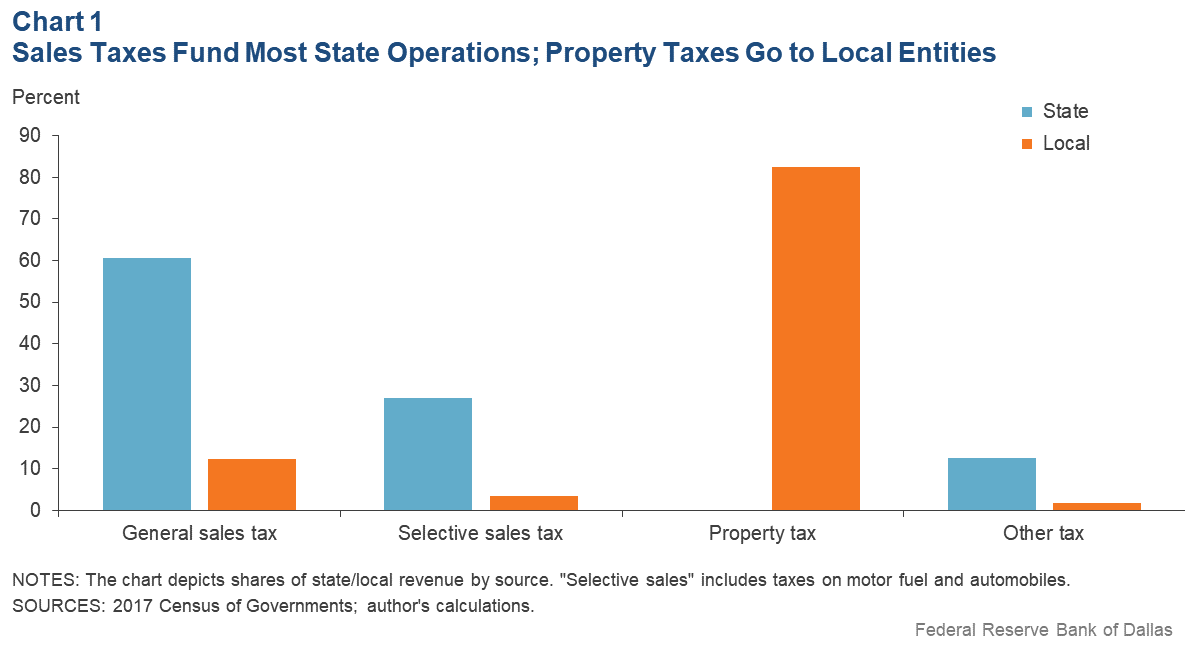

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Texas Sales Tax Guide For Businesses

Understanding California S Sales Tax

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Understanding California S Sales Tax

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

What Is The Austin Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Understanding California S Sales Tax

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Understanding California S Sales Tax

Understanding California S Sales Tax

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket